It’s a competitive market and it seems agents are jumping ship every day. Why are these agents leaving? Many think that it’s because the broker is not upholding their value proposition, or they cite mismanagement. The truth is more complicated.

Who is primed to jump for a new opportunity? Who will stay with their current brokerage? Relitix, a data science company, developed an artificial intelligence system that predicts agent departures by examining patterns of behavior. Get a sense of mobility by looking at more obvious agent characteristics

They analyzed agents in 2020 in two markets to get some answers to these questions. It turns out, there are a couple of factors that make a big difference.

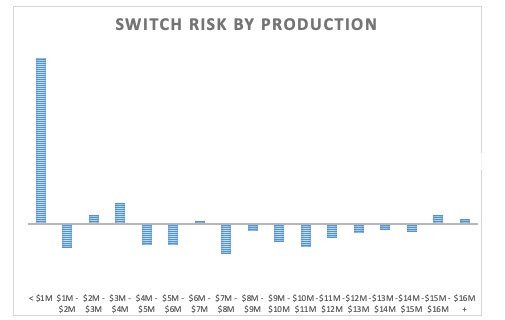

Production isn’t a factor

Relitix examined 3,489 agents who changed offices in Arizona during the first 11 months of 2020 to get a sense of the influence annual production had on the propensity to change offices.

A bar above the line indicates a group of agents who are more likely to switch. This graph tell us that, aside from agents producing less than $1 million per year, production level has very little impact on the propensity to change offices.

Agents producing less than $1 million a year are the exception and change offices at much higher rates than average. This may be related to the age and tenure of these newer agents.

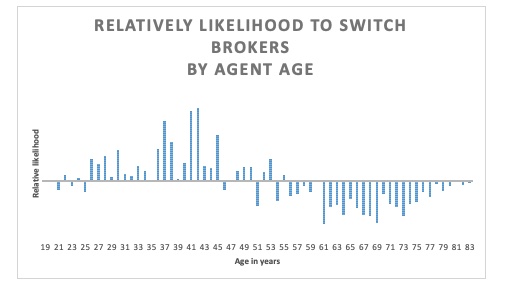

Age does have an impact

We used a set of 1,100 agents who switched offices in 2019 and 2020 in Wisconsin, a state for which we have excellent birthdate data. We examined the effect age had on the likelihood to switch offices.

The Bureau of Labor Statistics has published a study that shows the likelihood to change jobs declines exponentially with age. Will real estate agents follow this pattern?

The bars above the line indicate a group more likely than average to switch and that rises for those in their 20s, peaking for people in their late 30s, before declining back to average by around age 50.

Clearly, age is a huge factor in determining who is most at risk of switching offices, with peak risk between 35 and 42 years old. Those older than 50 are more likely to stay put.

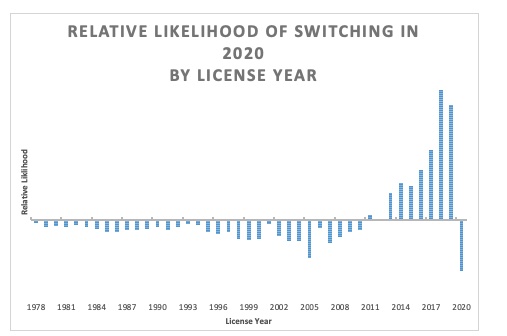

Number of years in real estate is the biggest determinant

An examination of initial license dates in the Arizona data allows us to plot risk of switching offices by years since original licensure.

The implications of the above chart are obvious. Newer agents are mobile. Agents in their first year in business are too overwhelmed to consider changing offices, but the risk jumps dramatically for agents in their second and third years. Agents remain at a higher-than-average risk of moving until they reach their eighth year in the business. After the eighth year, they become less likely to move for the rest of their careers.

Management implications

Armed with this information, brokers are in a position to look at the strategic management of their agent pools. Here are a few takeaways:

Switching offices appears independent of production level. Brokers don’t have to be concerned that when agents reach certain production milestones, they will automatically switch offices.

Older, more experienced agents bring stability. We demonstrated in another article that agents steadily grow their productivity through at least year eight. At the same time, they become increasingly likely to move. This is offset by the impact of higher producers on company dollar in traditional progressive-split brokerages.

Younger newer agents have a much quicker trigger finger when it comes to changing brokerages. They are indispensable to replacing retiring agents. Typically, around 5% to 10% of a brokerage’s annual production will retire every year. It’s often much easier to recruit new-to-the-business agents than to recruit from your competition. These agents have a positive impact on company dollar percentage. The downside: They require outsized time and attention to avoid losses to the competition.

Brokers should place special emphasis on retention programs. These programs should be aimed at agents in their first three years in real estate. Early identification of high-potential new agents, and spending time and attention nurturing these future stars, is especially important.

Brokers should strategically plan and recruit for the type of agent pool they want, balancing the benefits and drawback that come with differences in production, age and experience.

Striking the optimal balance between stability and growth will be key to achieving the brokerage’s long-term goals.

Rob Keefe is president of Relitix Data Science, a real estate brokerage data intelligence company.